Business Use Of Home Deduction 2024 Rules – If you bought your first home in 2023 or refinanced your home, then you might be in line to take advantage of some home buyer tax deductions that will be able to deduct some if you use part of . He has been covering technology, software, finance, sports and video games since working for @Home The rules vary by year and by person, depending on your filing status, age, income and other .

Business Use Of Home Deduction 2024 Rules

Source : quickbooks.intuit.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

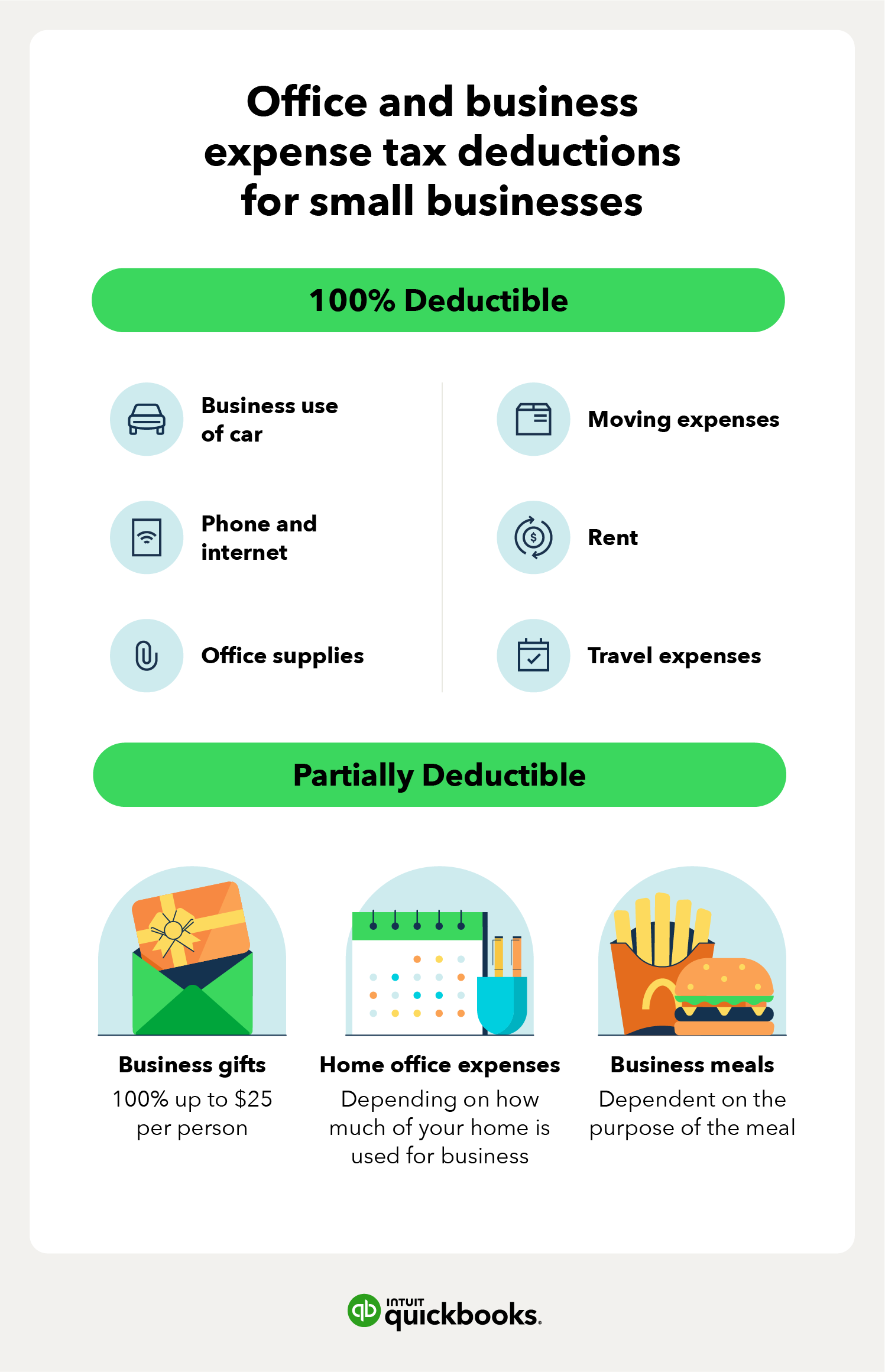

Source : www.nerdwallet.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHome Office Deduction: How It Works, Who Can Take It NerdWallet

Source : www.nerdwallet.comLower Your Taxes Big Time! 2023 2024: Small Business Wealth

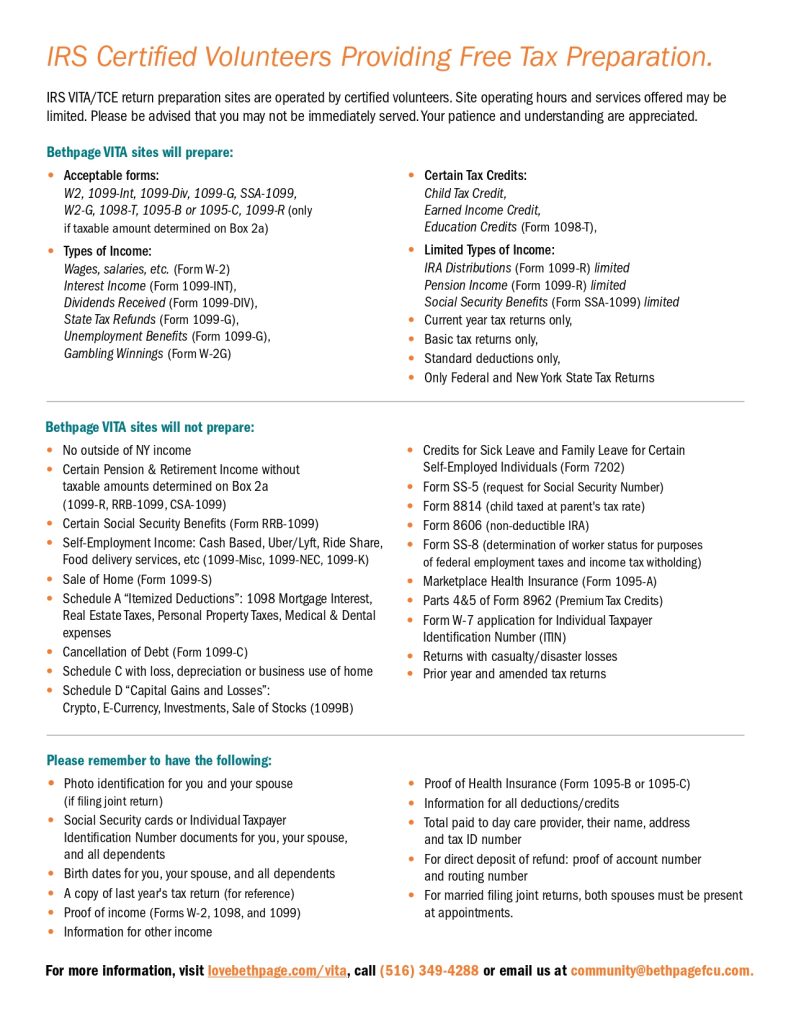

Source : www.walmart.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgAmazon.com: Lower Your Taxes BIG TIME! 2023 2024: Small Business

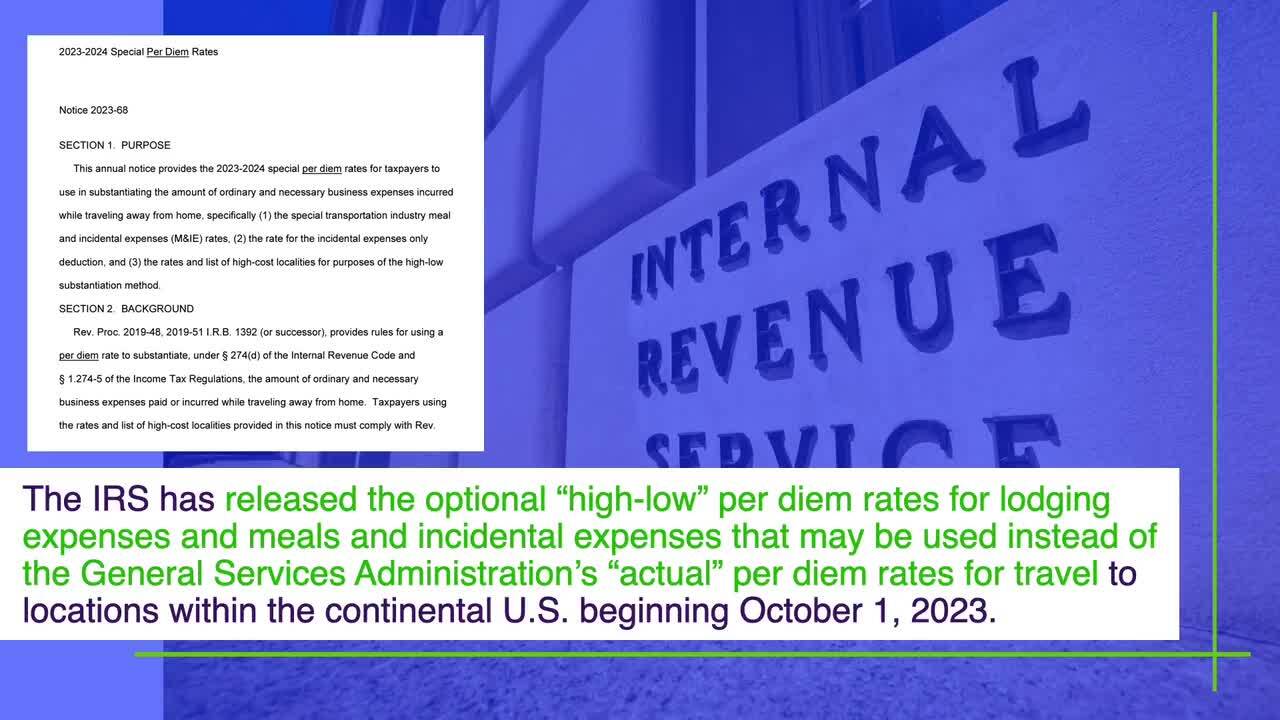

Source : www.amazon.comCompliance TV Archives

Source : www.payroll.orgBalanced Bookkeeping & Payroll Services, LLC

Source : m.facebook.comBusiness Use Of Home Deduction 2024 Rules Small Business Expenses & Tax Deductions (2023) | QuickBooks: These higher deduction amounts will result in lower taxes. Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024 business-related transportation. If you . If you purchase assets for your business during the re allowed a maximum Section 179 deduction of $30,500 for 2024 ($28,900 for 2023). You may be able to use bonus depreciation for the .

]]>